Blog

The Real Value of an Insurance Agent: More Than Just a Quote

In today’s digital world, it’s tempting to click your way through big decisions—including buying insurance. With direct-to-consumer insurance companies advertising convenience and low prices, many people are skipping insurance agents altogether. But is that really the best choice? Here’s why working with an independent insurance agent can save you time, money, and headaches in the long run. Read More

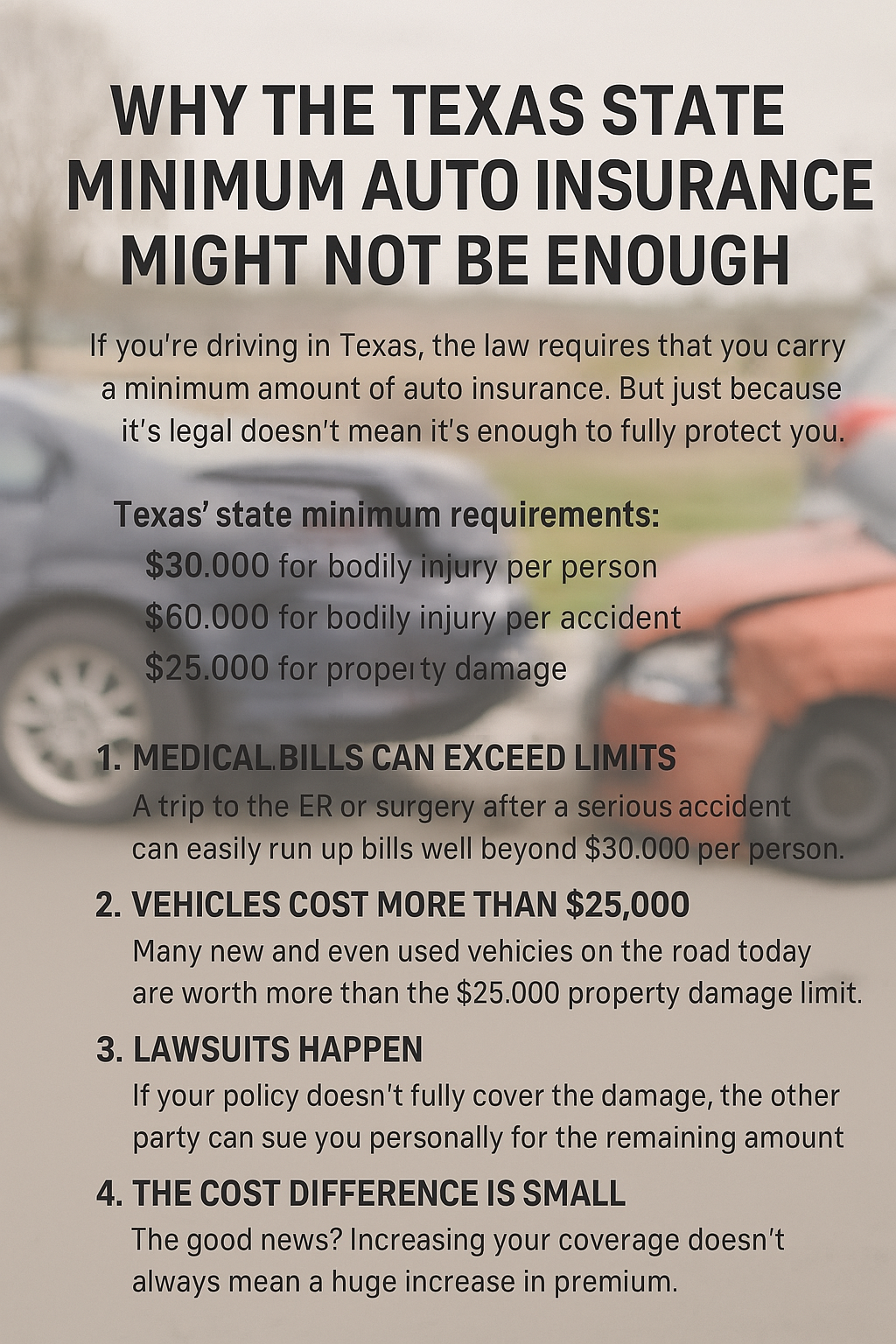

Why the Texas State Minimum Auto Insurance Coverage Might Not Be Enough

If you’re driving in Texas, the law requires that you carry a minimum amount of auto insurance. But just because it's legal doesn't mean it’s enough to fully protect you. Read More

Homeowners Insurance Coverage Explained

Explanation of homeowners coverages Read More

Why Are Car Insurance Rates Going Up?

Car insurance rates have gone up over 17% in the past year, according to the U.S. Bureau of Labor Statistics. Key factors are inflation, supply shortages, climate change and reinsurance rates Read More

Why are my premiums increasing?

There are several reasons why insurance rates may be going up, including: claims, natural disasters, inflation, and more. Read More

Kathleen is Retiring!

Kathleen is retiring but you will be in good hands with Jeremy. Please read more. Read More

We are here to help!!!

We are here for you and available to assist you in any way possible with your insurance needs. Email or call to let us review your policy to see if we can make any adjustments to help you with your insurance premium. Read More

How to prepare for COVID-19

How COVID-19 spreads, steps to protect yourself and others. Information provided by the Centers for Disease Control and Prevention. Read More

Auto Coverages

Sometimes it can be confusing when choosing auto coverage options. Let us help you better understand the coverage options we offer. Read More

Flood Insurance: Low-Risk Doesn't Mean No-Risk

When it comes to flooding, these disasters can happen any time of the year, anywhere across the country. In fact, 25% of all flood damage in the U.S. occurs in what are classified as low- to moderate-risk flood zones. This is especially troubling when, as the NFIP estimates, just one inch of water intrusion can cause more than $20,000 in damages, and the average flood claim is around $43,000. Read More

Why updating our information is critical for your insurance policy success

Updating your personal information is important to your policy. Please contact our office to update your current personal information or if you have any questions about your policy. Read More

5 Reasons Why We Need Insurance

Protect your investment, required by lender, law, temporary use and peace of mind. Read More