Flood Insurance: Low-Risk Doesn't Mean No-Risk

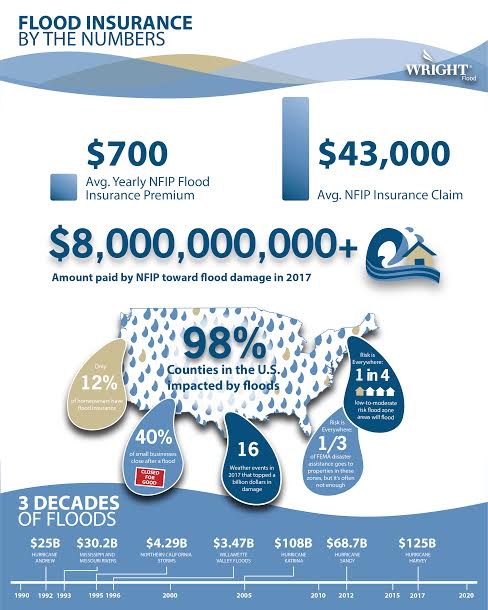

In 2017 alone, the National Oceanic and Atmospheric Administration reported 16 separate disasters in the U.S., each with damages exceeding $1 billion, which generated total record losses in excess of $306 billion. A large percentage of these damages were caused by flooding, including damages associated with Hurricane Harvey in Texas and Louisiana, and record high water levels in Missouri, Arkansas and Illinois. While this devastation has certainly brought the conversation about flooding and flood damage back to the forefront, it also may have relayed a subtle, worrisome message to others: Flooding events only affect certain regions at certain times of the year, and 2017 was an anomaly.

The reality is quite the opposite.

When it comes to flooding, these disasters can happen any time of the year, anywhere across the country. In fact, 25% of all flood damage in the U.S. occurs in what are classified as low- to moderate-risk flood zones by the National Flood Insurance Program (NFIP), and destructive flood events have occurred in 98% of counties across the country. This is especially troubling when, as the NFIP estimates, just one inch of water intrusion can cause more than $20,000 in damages, and the average NFIP claim is around $43,000. In addition, one-third of FEMA disaster assistance goes to properties in these low- to moderate-risk zones, but it’s rarely enough to cover the damages.

Simply put, flooding is the costliest and most common natural disaster in the U.S., especially considering that it can strike any time of year. Ultimately, a single flood event can destroy a property and wreak irreparable damage on the finances of uninsured home and business owners. Yet, despite these dangers, only 12% of homeowners have flood insurance. For those in low-risk areas or those without mortgage loans not required by their lenders to purchase NFIP policies, this is a huge problem. Consider the following:

- A March 2017 survey by InsuranceQuotes found that 56% of respondents mistakenly believed that a standard homeowners policy covers flood damage.

- Most business insurance policies exclude flood damage.

- FEMA flood maps may be outdated, and flood risks are changing rapidly. Some research suggests that current maps vastly underestimate those in the high-risk, 1-in-100-year floodplain, with one study suggesting that 40 million Americans, instead of the current estimate of 13 million, are at high risk.

- Hurricane Harvey hit low-risk flood areas, and fewer than 20% of homes damaged in Hurricane Harvey were flood-insured. In total, just 15% of all the 1.8 million homes in Harris County (Houston) had flood insurance, including only 28% of the homes in high-risk areas.

- NFIP policies in low-risk, preferred risk areas are as low as $500 a year, while a flood claim averages $43,000.

source: http://insurancethoughtleadership.com/low-risk-doesnt-mean-no-risk/